By Theresa Struckmeyer

Senior Health Specialist

MP Insurance Solutions

For an Instant Online Medicare Supplement Quote, click here.

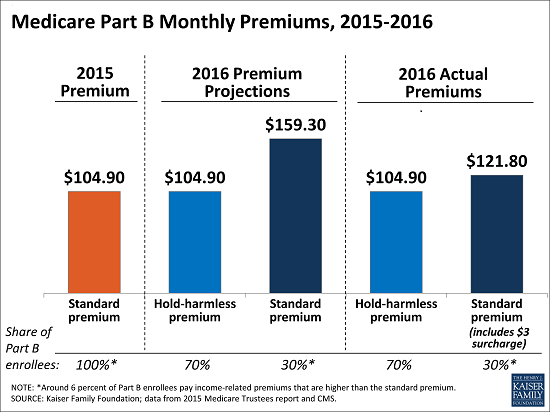

For months there has been ugly rumors going around that Medicare Part B premiums and deductibles would be going up by as much as 50% or more for some. Now we are pleased to report that the rumored increases, although not completely false, is not as bad as many had feared and the final numbers are in.

There will be an increase of premium in 2016 from $104.90 to $121.80 for those who qualify for the premium hike. Although this is a hard pill to swallow, it is much better than estimates earlier which pointed to an increase of more than $50 per month. The other bit of good news is that about 70% of seniors who have Medicare will not be effected by this premium increases. Most seniors who are collecting Social Security will not be subject to the increase. Additionally, seniors who have their Part B Premium paid by Medi-cal will not be affected.

So who will be subject to the premium increase? Seniors who are applying for Medicare Part B for the 1st time in 2016 , those who are in the higher income brackets over $80,000 for single seniors or $170,000 for married seniors, and seniors who have yet to collect social security will be subject to the premium hike. For those seniors who are subject to additional premium due to income, the new premium will be between $146.90-$335.70. The higher your income, the higher the premium.

There has also been talk of Part B Deductible increases but luckily things in this regard are not as bad as originally expected. Part B Deductible will be going up from $147 to $166 for all beneficiaries. Additionally, Part A deductible will be going from $1260 to $1288 and co-pays for longer hospital stays over 60 days will be going up slightly.

Even though the news is not as bad as originally expected, the higher costs will be hard for many seniors to budget. For those seniors who are currently on a Medicare Supplement plan, it is a good idea to compare your rates to see if there is a possibility to save money for a similar plan. Even those seniors not subject to premium hikes should look into it as many are able to save hundreds a year for the same plan. For more information on why it is good to compare your plan, click here.

For seniors who will be new to Medicare in 2016, it’s important to find the best plan to suite your needs and budget from day one. Talking to an agent who specializes in Medicare Supplement and is knowledgeable about the changes to Medicare and who it will effect, is a good place to start.

Every senior’s needs are different. Have a question? We are here to help! We are just a phone call 1-855-731-8888, email, or online chat away. We have been helping seniors with their insurance needs since 1995 and would love to help you as well!

For an Instant Online Medicare Supplement Quote, click here.

#########

MP Insurance Solutions is a Senior Health Care Insurance Brokerage. We specialize in Medicare Supplement/ Medigap plans, Medicare Advantage/Medicare Part C, Prescription Drug Plans/Medicare Part D, Senior Term Life Insurance, Final Expense Insurance, Guaranteed Income Annuities, and Dental and Vision plans. We specialize in helping seniors in Southern California including Los Angeles, Riverside, San Bernardino, San Diego, and Orange County California.